sales tax on leased cars in maryland

On average 575 applies as a car trade-in services in Maryland while purchasing a new car according to new rules and regulations. Ask the Hackrs.

2012 Chrysler 200 Touring Http Www Localautosonline Com Used 2012 Chrysler 200 Convertible Touring For Sale Pensacola Fl Chrysler Cars Chrysler 200 Touring

3 cents if the taxable price is.

. Aug 28 2014 Sales tax on Maryland leased vehicle. Calculate Tax Over Lease Term. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

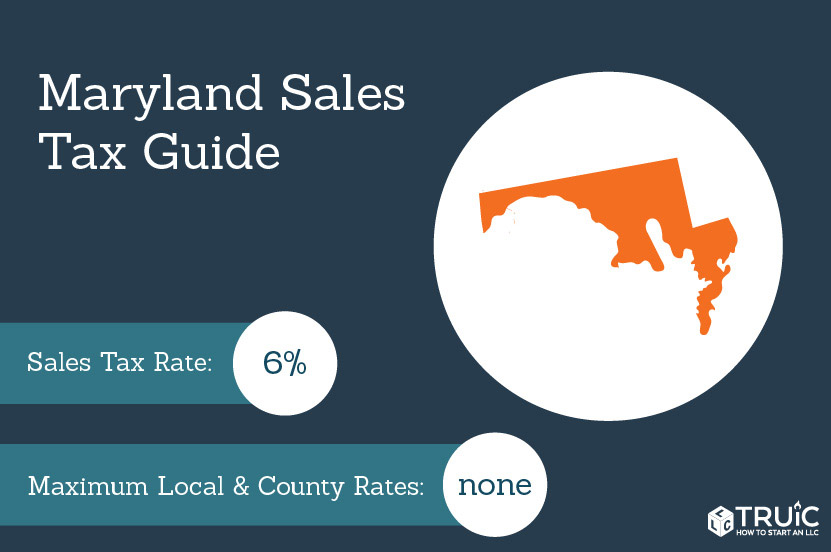

Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows. Average DMV fees in Maryland on a new-car purchase add up to 1051 which includes the title registration and plate. The potential saving costs for 288 trade-in worth 5000.

Or is the sales tax only on the lease payment portion. For example if the monthly lease payment is 300 and the sales tax is 8 percent the total payment is 324. Every time you purchase taxable tangible goods whether in person over the phone or on the Internet the purchase is subject to Marylands 6 percent sales and use tax if you use the merchandise in Maryland.

While the state sales tax is on the high side it is balanced by the lack of other taxes. Hey Hackers I am considering leasing a vehicle instead of buying it for the 1st time. To find current information about official fees and sales tax when leasing a car in your state search online for your states Department of Motor Vehicles and Department of Revenue web sites.

Effectively the payment will go up by 98. In contrast taxes were 450 in Virginia. In Maryland you do not have to pay any sales tax at any other level though.

You can calculate the trade-in incentive on your vehicle by applying this percentage to your new car price. If you transfer a lease from Oregon to WA the leasing bank will start collecting sales tax on the payment each month 98. If you make a tax-free purchase out of state and need to pay Marylands 6 percent use tax you should file the Consumer Use Tax.

Maryland taxes vehicle purchases before rebates or incentives are applied to the price which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full 10000. Sales tax on Maryland leased vehicle. And I am being told that for Maryland I have to pay the whole car price in tax IE 22000 price after negotiations x 6 1320.

You must pay sales tax when you lease a car. The main ones are. This page describes the taxability of leases and rentals in Maryland including motor vehicles and tangible media property.

Rocktimberwolf December 21 2015 252am 1. If a Maryland dealer is. Some lease buyout transactions may be excise tax exempt.

This means that whether youre buying used or new you will have to pay an additional 6 on your car purchase. Trailers purchased for 320 and less is 1920. The state sales tax in Maryland is 6.

2 cents if the taxable price is at least 21 cents but less than 34 cents. Sales tax is a part of buying and leasing cars in states that charge it. To learn more see a full list of taxable and tax-exempt items in Maryland.

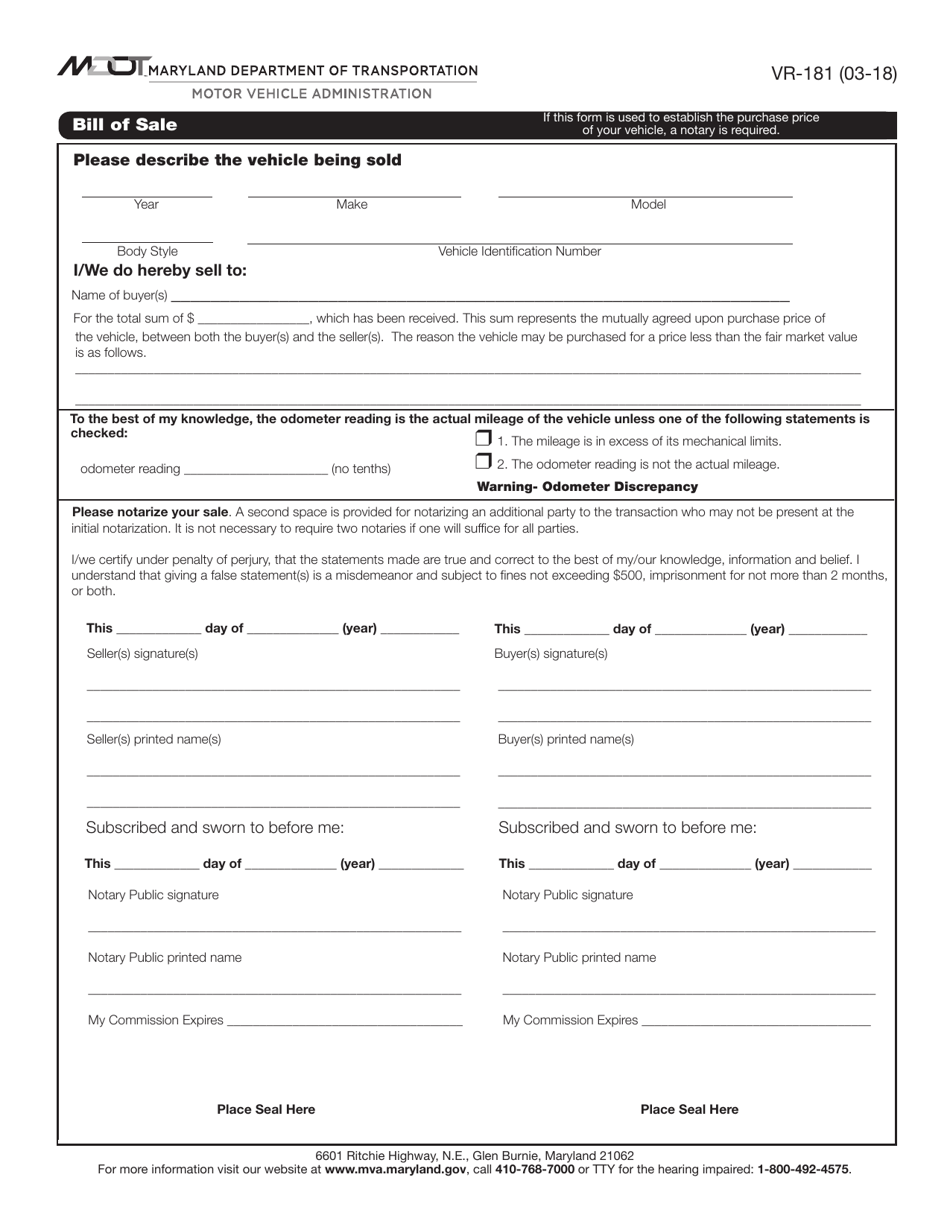

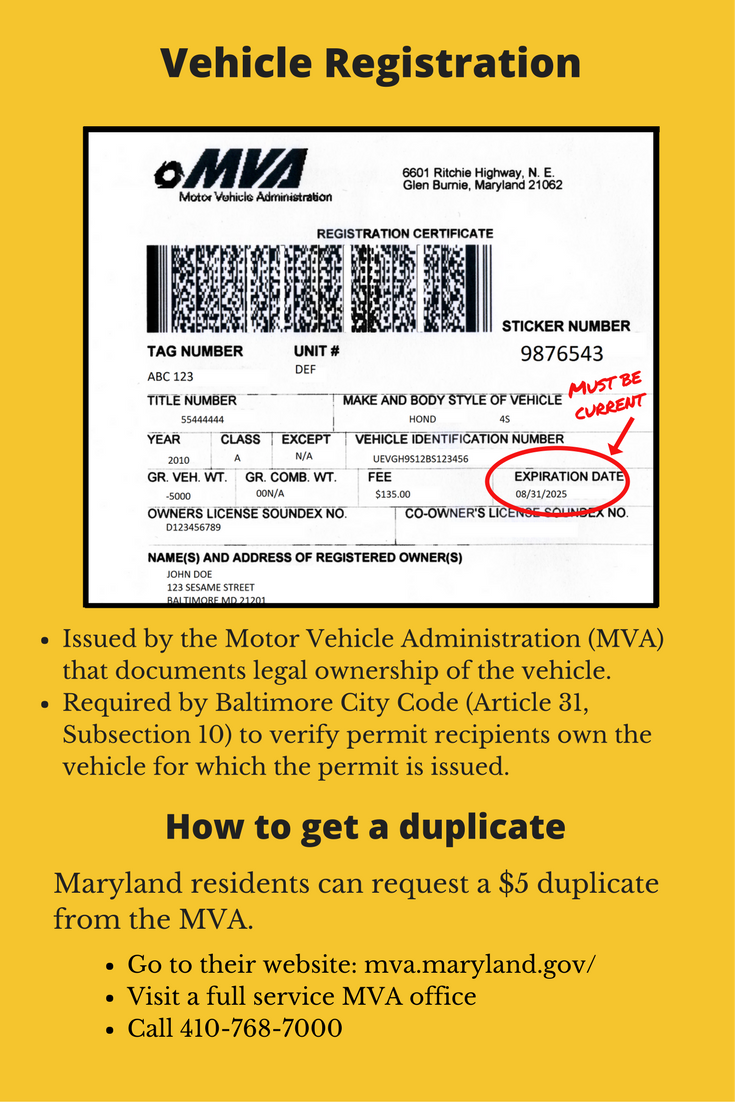

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. For example the combined taxes imposed for leasing a 15000 car and then buying it after two years were 1521 in Maryland. Maryland Safety Inspection Certificate This Maryland State Police form certifies that your vehicle meets Maryland safety standards and is required only if the vehicle is used.

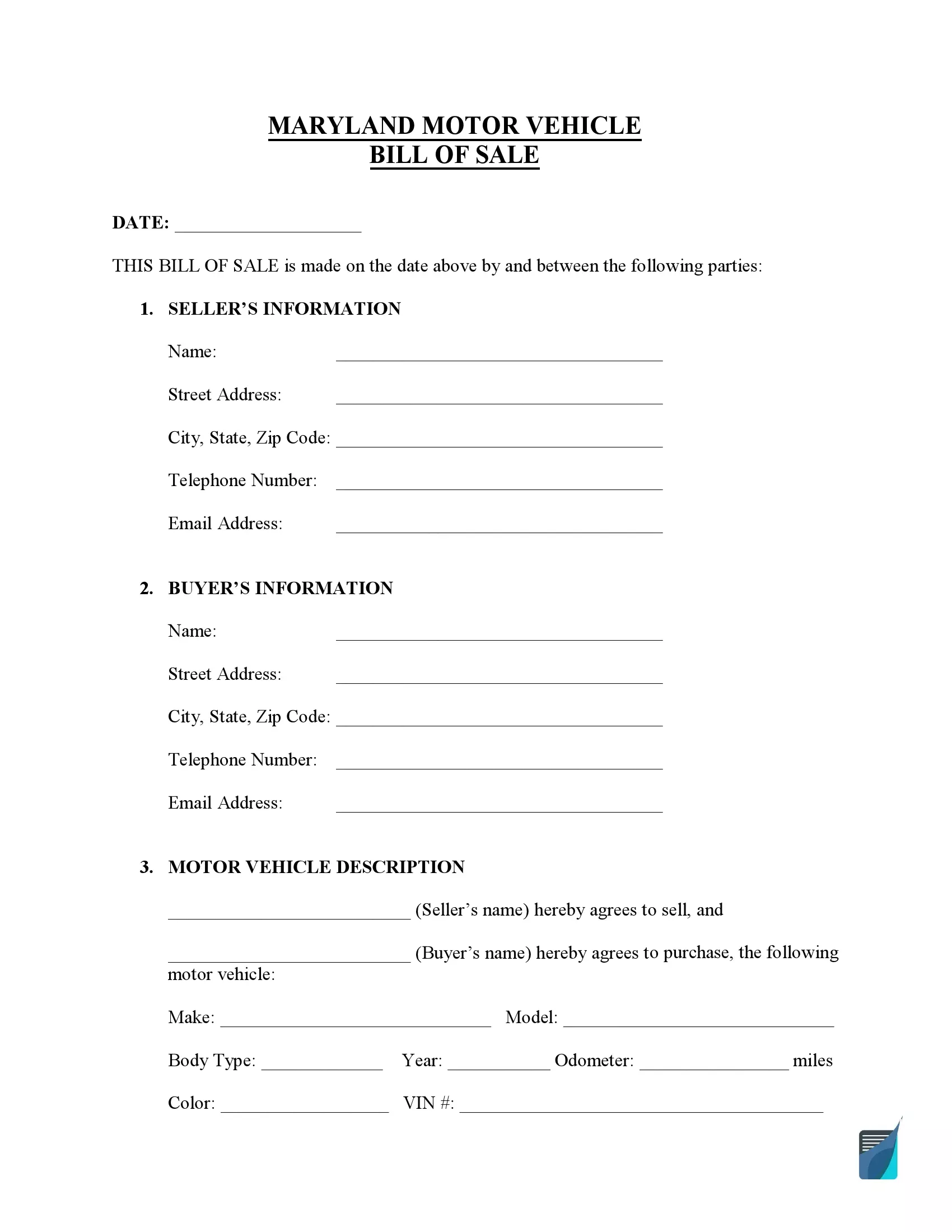

When you purchase a car you pay sales tax on the total price of the vehicle. In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments.

These fees are separate from the sales tax and will likely be collected by the Maryland Department of Motor Vehicles and not the Maryland Comptroller. Like with any purchase the rules on when and. With a 24 month lease that increases the monthly by 55.

If you transfer from CA to WA the CA tax portion of the lease will cease but as above WA tax will be collected. The fee for registration varies by the type of vehicle its weight andor its intended use. See Fees for Registration Plates for more information.

Admin Car Leasing Fees Charges and Taxes Explained 05022021. Heres an explanation for. Maryland sales tax on leased cars - WTF.

Remember that sales tax applies to the total. Please provide a credible reference to confirm this if possible. The average car buyer in Maryland should expect to spend approximately 105 for the title registration.

For older vehicles the tax is calculated on the purchase price. Please read the next section Lease Contracts. Certificate of origin This is an ownership document produced by the vehicles manufacturer.

For vehicles that are being rented or leased see see taxation of leases and rentals. The fee for titling a vehicle typically includes a title fee excise tax and a security interest lien filing fee if required. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car.

1 cent on each sale where the taxable price is 20 cents. In most states you pay sales tax on the monthly lease payment not the price of the car. Think of it this way.

For example if the monthly lease payment is 300 and the sales tax is 8 percent the total payment is 324.

Used Land Rover Range Rover For Sale In Baltimore Md Cargurus

New Mercedes Benz Models Annapolis Mercedes Benz Dealer

Effective Oct 1 2016 Maryland Historic Plates Get New Rules Find Car Meets

Form Vr 181 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Maryland Templateroller

Sales Tax On Cars And Vehicles In Maryland

Maryland Car Registration A Quick Guide To The Basics Darcars Chrysler Dodge Jeep Ram Of Silver Spring Blog

1987 Jeep Cherokee Laredo 4x4 Lt Gt Super Clean Jeep Lt Gt Good On Gas Jeep Cherokee Laredo Jeep Cherokee Cherokee Laredo

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

New 2022 Hyundai Elantra Near Me Hagerstown Md Massey Hyundai

Required Customer Documents Parking Authority

Maryland Car Tax Everything You Need To Know

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template Memories List Template Nephew And Aunt

Free Maryland Vehicle Bill Of Sale Form Pdf Formspal

2015 Toyota Camry Review New Car Review Toyota Camry Luxury Car Hire Camry