special tax notice voya

Voya Retirement Insurance and Annuity Company VRIAC Voya Institutional Plan Services LLC VIPS Members of the Voya family of companies PO Box 990063 Hartford CT 06199. Received and read this notice when requesting a withdrawal.

Voya Financial Hit With Class Action In Connecticut Connecticut Law Tribune

If your payment includes after-tax contributions.

. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits. SPECIAL RULES AND OPTIONS. SPECIAL RULES AND OPTIONS.

Trs members of applicant the special tax information notice is We make it easy for you to make a positive change to your financial future. You can get a copy at VoyaRetirementPlans. You may roll over to an IRA a payment that includes after-tax contributions through either a direct rollover or a 60.

SPECIAL TAX NOTICE For Payments Not from a Designated Roth Account State Form INSERT FORM NUMBER Indiana Public Retirement System One North Capitol Ave Suite 001. The IRS requires an employer to provide a notice to all employees eligilble to participate in the 403b plan at least once annually about the opportunity to contribute to the 403b plan. This notice provided in accordance with federal tax laws is intended to describe the tax consequences of distributions from the Savings Plan of amounts that are from a designated.

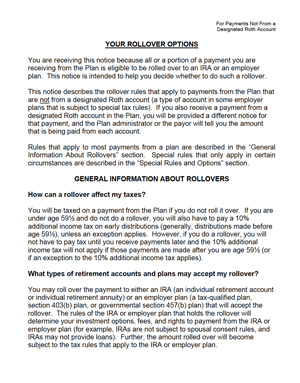

Special Tax Notice Notice Regarding Plan Payments- Your Rollover Options This Notice is provided to you by Nestlé USA Inc. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either. This notice does not address any State or local income tax rules including withholding rules.

From the plan until at least 30 days after you receive this notice. You have at least 30 days after receiving this notice to consider whether or not to have your distribution directly rolled over. If you are under age 59½ you will have to pay the 10 additional income tax on early distributions for any payment from the Plan including amounts withheld for income tax that.

Comtaxnotice or call the Customer Contact Center at 1-800-584-6001. Your Plan Administrator because all or a portion of a. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

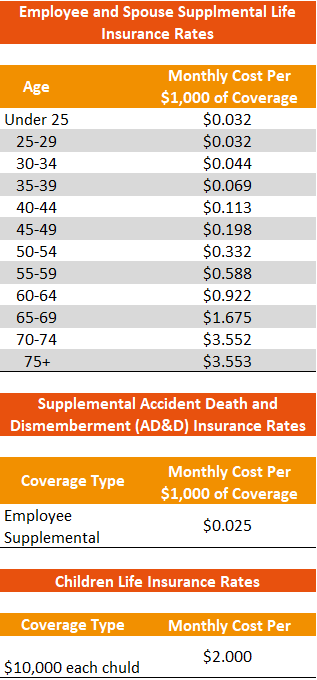

In addition special rules apply when you do a rollover as described below. A notice containing important information that you need to know prior to receiving a distribution or withdrawal from the Plan. Any changes in rates will apply to all amounts in the.

This notice does not address any State or local income tax rules including withholding rules. If your payment includes after-tax contributions. You are receiving this notice in the event that all or a portion of a payment you are receiving from the ExxonMobil Savings Plan Plan is eligible to be rolled over to a Roth IRA or designated.

Request A 401 K Fee Comparison Employee Fiduciary

401k And Non 401k Hardship Withdrawals Aba Retirement Funds

Deferred Compensation Complete Details Multnomah County

401k And Non 401k Hardship Withdrawals Aba Retirement Funds

Think Your Retirement Plan Is Bad Talk To A Teacher The New York Times

Amazon Com The Passive Programming Playbook 101 Ways To Get Library Customers Off The Sidelines 9781440870569 Willey Books

Retire Plan Save Retire Myfloridacfo

Adp Totalsource Retirement Savings Plan

Benefits Flexible Spending Accounts

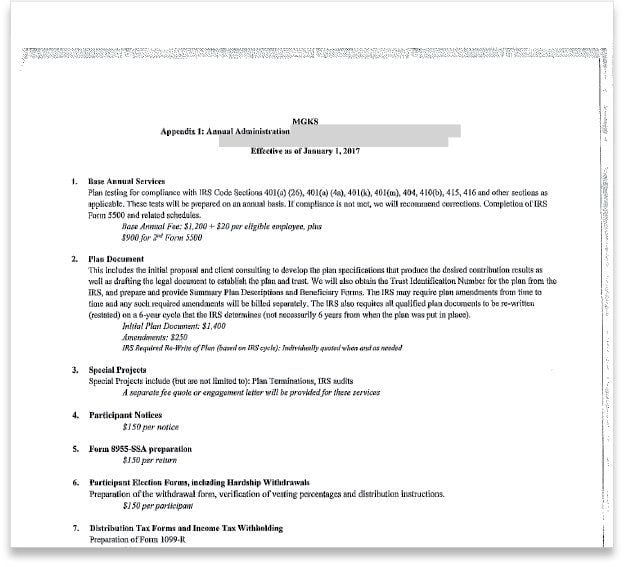

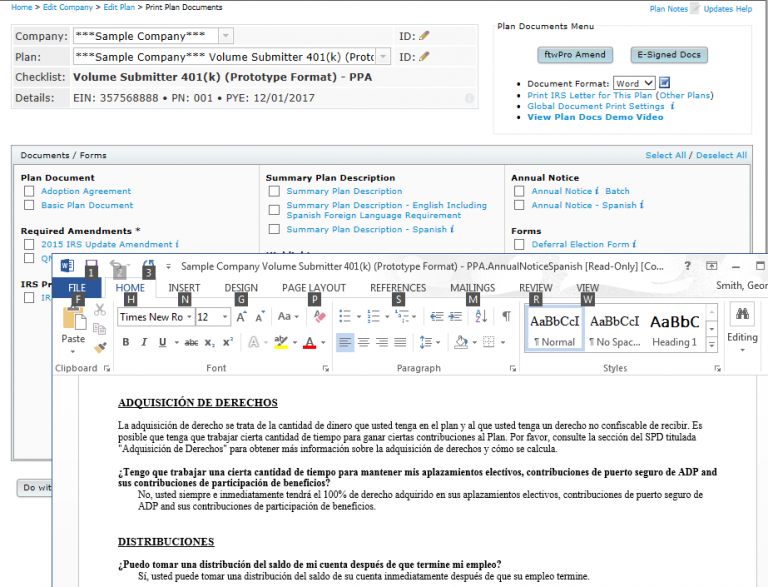

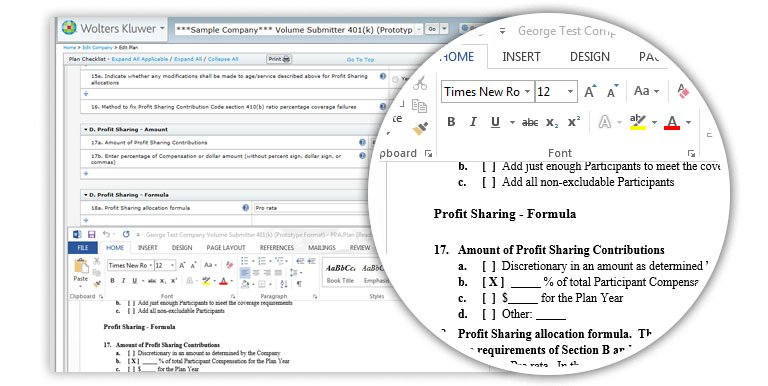

Retirement Plan Documents Ftwilliam Com Wolters Kluwer

Ex Voya Client Seeks To Vacate Finra Arbitration Award Financial Planning

Amazon Com House Of Night The Beginning Marked And Betrayed House Of Night Novels 9781250037237 Cast P C Cast Kristin Patterson Monique Books

In Service Withdrawals Aba Retirement Funds

Retirement Plan Documents Ftwilliam Com Wolters Kluwer